The Problem

At Kids' Bank, we believe that the best way for kids to learn about money is to see money in action. In the past, this meant pocket money and piggy banks. But these days, when kids become young adults, they enter the world, which has largely gone cashless. Think checking accounts and paying with plastic. Psychologically, this is a lot different from spending cash. Throw debt to the mix (AKA credit cards), and it's easy to lose track of the balance.

The Solution

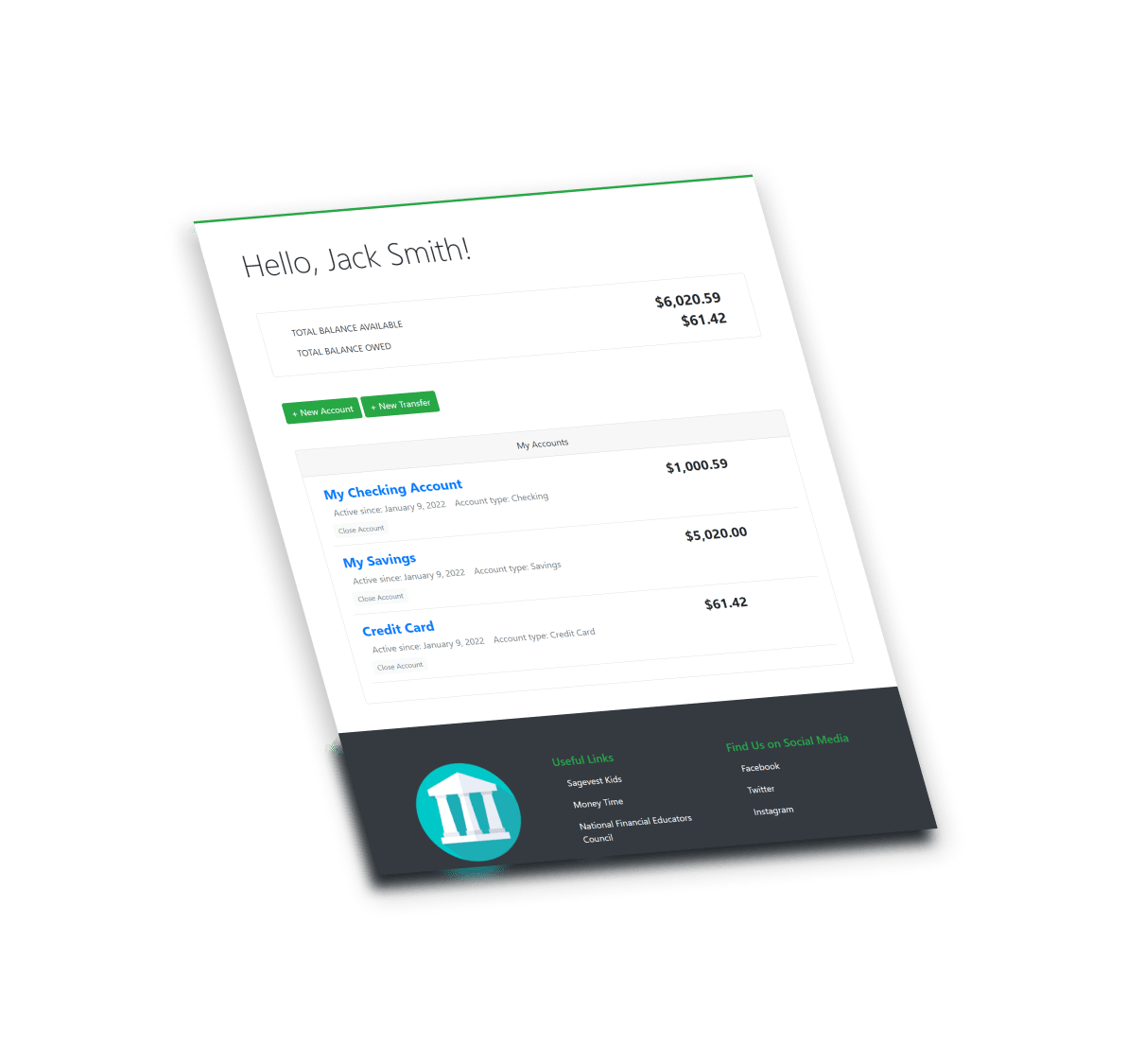

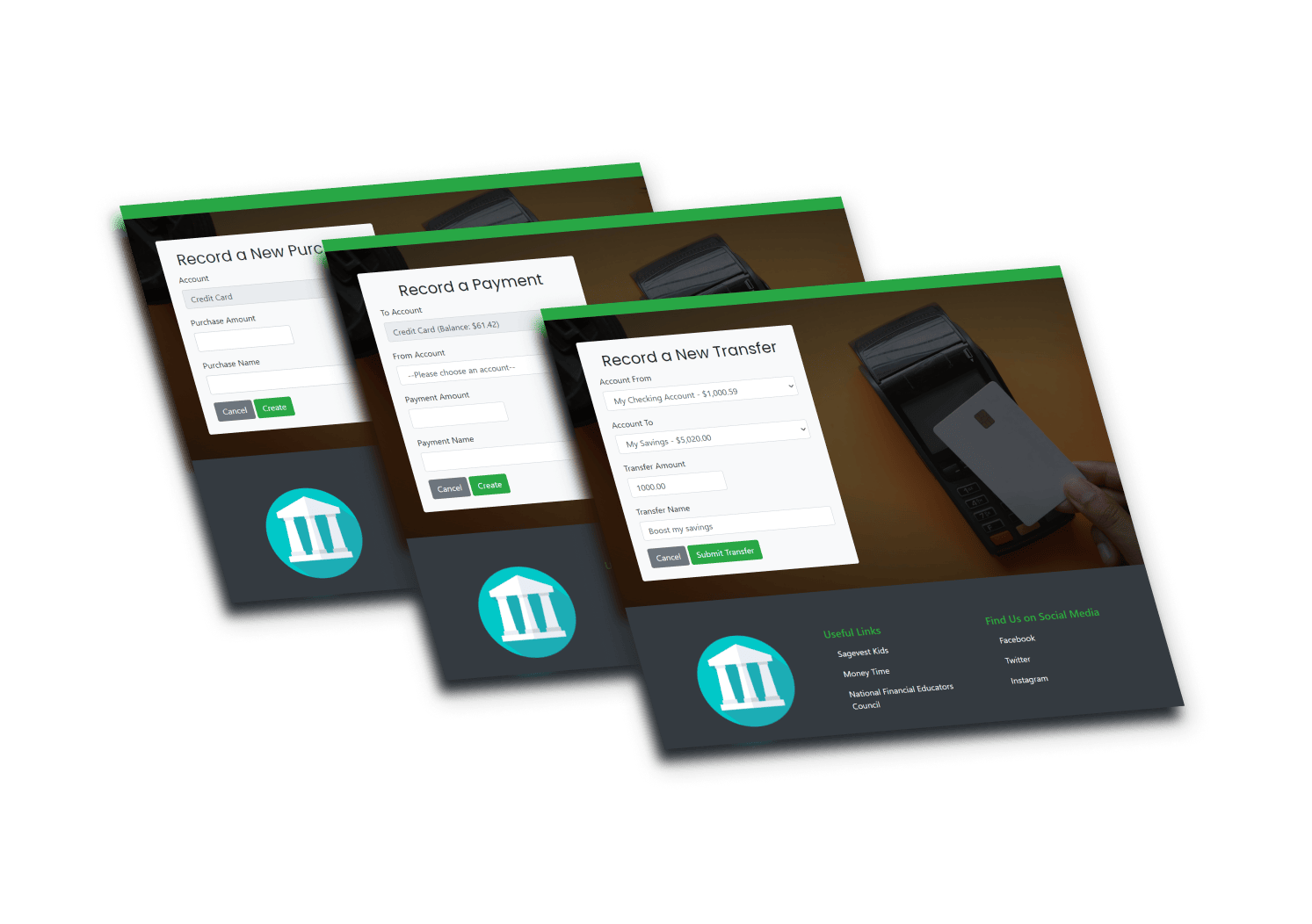

Let kids use a bank account! A Kids' Bank play account. Let them see their money accumulate interest if they save, or pay for interest if they forget to pay their bill. Let them "make a purchase" on credit and remember to pay it off on time. If it's past due, this bank will charge interest! You just add transactions.